Note: VMware SD-WAN by VeloCloud is publishing a blog series on business continuity and what we’re doing to support our community, customers, and partners amidst the COVID-19 pandemic. Check out these other published pieces:

- Enabling Business Continuity with VMware SD-WAN

- Is Your WAN Prepared for the COVID-19 Pandemic? It will be with SD-WAN

It’s an understatement to say that the COVID-19 pandemic has changed every facet of our lives over the last few weeks. Organizations everywhere, including businesses, educational institutions, and public venues such as airports and stadiums, are all adapting to these times. As our CEO, Pat Gelsinger, articulated, this “will permanently change the way we work, learn, connect, worship and simply how we live in community with each other.”

These changes are manifesting in some obvious and less intuitive ways as organizations look to maintain productivity, network use, and application consumption patterns. This post summarizes observations we’ve made and behaviors across different enterprise environments using our network analytics and monitoring platform (via the acquisition of Nyansa, now part of VMware). We’ve also provided tips (found at the end of this blog) on how your organization can adapt in these changing times.

General Enterprise

With businesses requiring employees to work at home and shelter in place, there has been a significant reduction of users on enterprise networks. Let’s take a look at the data. (Note: All screenshots and images are derived from the Nyansa, now part of VMware platform but have been camouflaged so that no company names or network information is disclosed.)

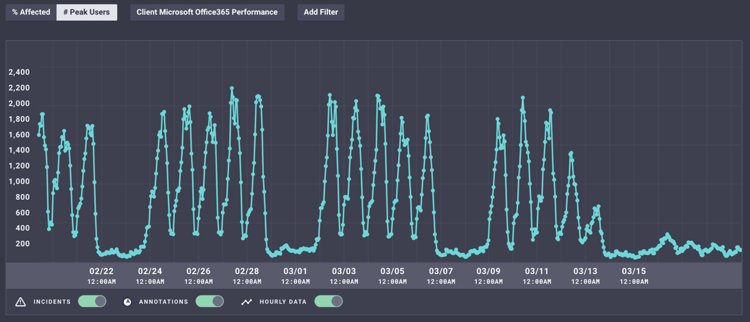

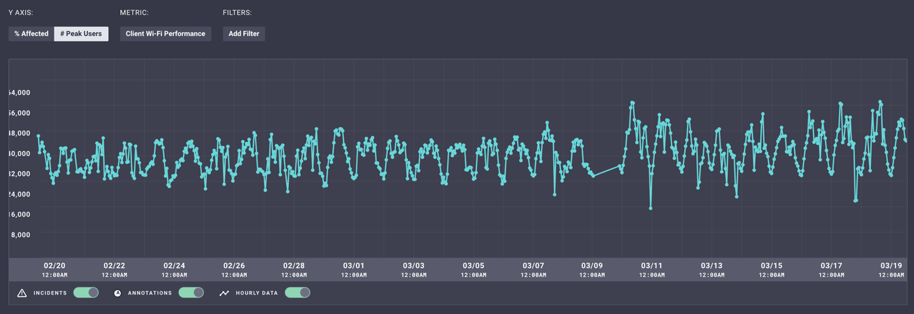

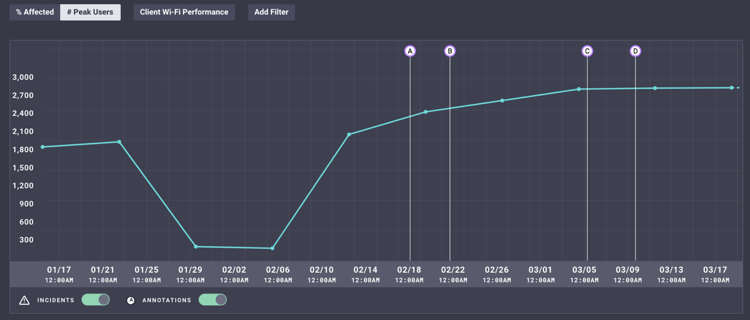

In Figure 1, the decline in users begins on March 9, when work at home directives were issued. On March 16, the requirement to ‘shelter in place’ in the Bay Area reduced the number of network users to only 30% of numbers from the previous week.

Most of these businesses rely on productivity and collaboration applications like Microsoft Office 365. While the usage indicators have declined significantly, for businesses to continue to remain productive, these cloud applications are now being consumed from outside the office and by those working at home.

Education

In the education sector, the case is slightly different, as universities and institutions of higher learning are foregoing in-classroom instruction to adhere to social distancing requirements. Instead, they are transitioning to online classes that utilize video conferencing collaboration applications like Zoom. Unlike the corporate world,where businesses require the workforce to work from home, not all students are electing or able to go home, including international students.

Two unmistakable trends are emerging in university campus environments:

- Net new adoption of online meeting applications like Zoom are being used for video instruction. Growth in adoption of organizations using applications like Zoom for instruction.

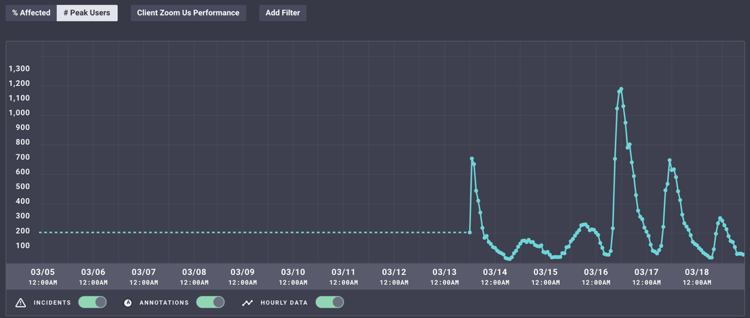

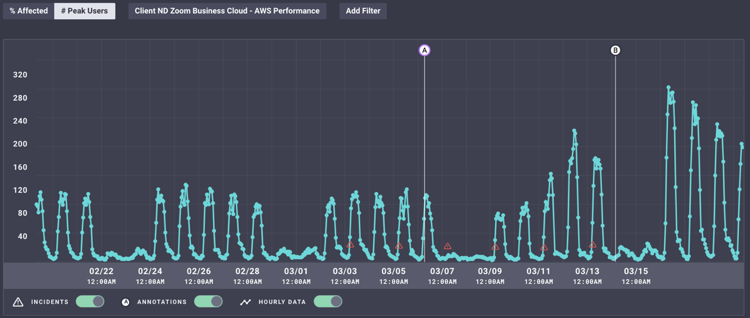

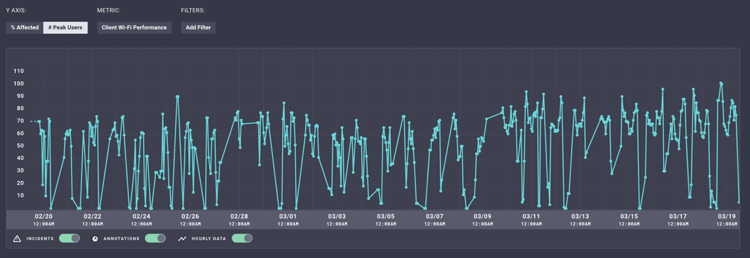

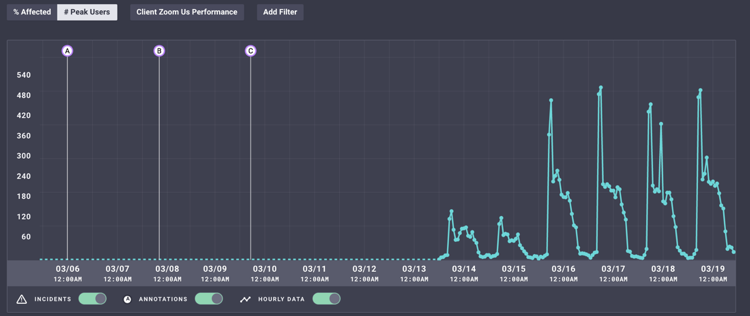

For net new adoption, the figure below highlights one of our university customers quickly adopting the Zoom application and moving to online courses (Figure 3), even as the number of students and faculty on campus has significantly decreased (Figure 4).

For residential campuses, where it’s harder for all students to go home (international students and for other reasons), there is a new user population baseline being established on these campuses. While the adoption of collaboration apps has increased dramatically, Figure 5 shows that this demographic is still on campus and using services, but the services being utilized have changed. In Figure 6, we can see the increase in Zoom adoption during this same period.

When normalized for the declining number of users on university campuses, the adoption of unified collaboration tools from the baseline has increased by over 6X.

Healthcare

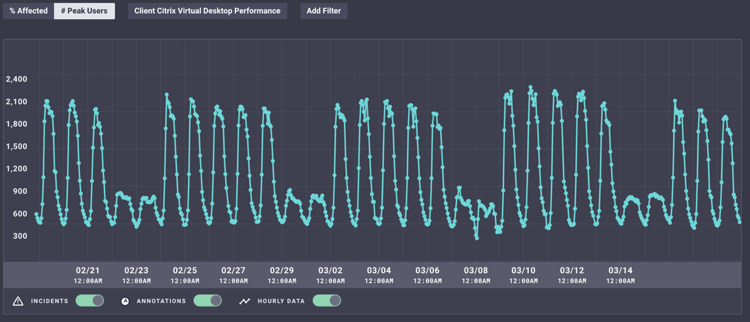

While non-medical businesses are requiring employees to work from home, hospital employees do not have the same luxury. There continues to be a need to deliver healthcare to patients and for healthcare employees to work on-site. In Figure 7, we see trends have declined only very slightly in the most recent period, unlike in other verticals.

In addition to hospitals remaining abuzz with network activity, client applications like virtual desktop infrastructure, used to access electronic medical reports and telemedicine applications, continue to be heavily accessed within hospitals (see Figure 8).

Retail

The retail vertical is interesting in these times given that some retail entities, like grocery chains and hardware stores, fall under the “essential services” category, as opposed to non-essential services, such as clothing stores.

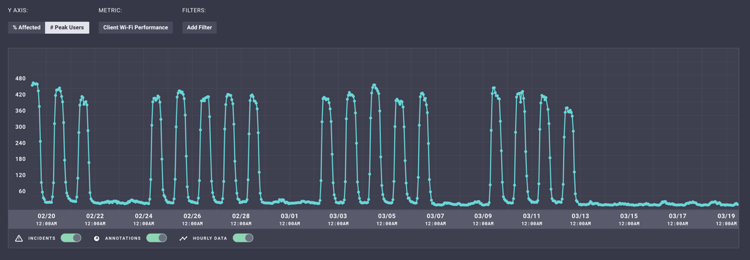

In the retail essential services category, we see an uptick in terms of both in-store activity, as well as distribution warehouse activity, as customers aggressively shop for items both in-person and online. Figure 9 shows the uptick in client activity across an entire chain of stores, whereas Figure 10 depicts a single, typical store within the chain.

For the non-essential service category of retail, the story is altogether different. The stores are completely empty of shoppers, but the distribution centers are humming with activity. Figure 11 shows a typical store dropping off completely after March 12, whereas Figure 12 shows a distribution center continuing to operate at max capacity over the same timeframe.

Light at the end of the tunnel?

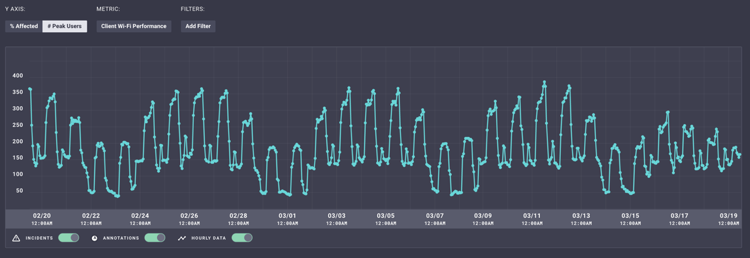

COVID-19 cases in the United States have lagged behind other parts of the world, like Asia, where we are seeing a steady recovery of users going back to the office following the peak of infection in those regions (Figure 13). The dip during January 29 to mid-February shows the instance of employees working outside the office and factories.

While employees may be back working in the offices in places like Asia, social distancing is still being practiced at work and large congregations of people are still being avoided. In the office, meetings are still being conducted virtually, with employees sitting at their desks and engaging over collaboration platforms like Zoom. To demonstrate, Figure 14 shows Zoom usage at an international factory in Asia.

Conclusion & Tips

Tip #1: For enterprises, users are now almost exclusively working from home and require that all productivity applications like Microsoft Office 365 be accessed from there. VMware SD-WAN™ by VeloCloud® is now offering service bundles to help with business continuity: VMware SD-WAN Work @Home.

Tip #2: Colleges are residential campuses and IT resources are still required to facilitate students who are working from these sites. Adoption of net new services like Zoom (which is now free for grades K-12), can help provide a semblance of normalcy in the education vertical.

Tip #3: Healthcare and other essential networks are abuzz. While it is critical to practice social distancing, it is clear that IT and network services are in even higher demand now. It is now even more critical to ensure they perform at maximum capacity without interruption.

Tip #4: When we all eventually return to working from the office, social distancing will still be required for some time, as we see in Asia. Collaboration applications are going to be needed more than even before.