In our role helping communication service providers (CSPs) reimagine their businesses, we tend to get a firsthand view of their digital transformation journeys. And it’s been impossible to miss one of the biggest topics on the minds of telecom leaders: network automation.

Most CSPs are moving full-steam ahead with transformation initiatives, seeking to virtualize and cloudify their networks, reduce costs, and tap into new service capabilities and revenues. Yet the more progress they make with cloud-native architectures, virtualized and containerized network functions (VNFs/CNFs), and modern software approaches like continuous integration/continuous delivery (CI/CD), the more complicated things get for network engineers. And the more CSPs view legacy manual-intensive operations as the biggest barrier to success.

We believe network automation is the only solution—there’s no viable way to achieve business and operational transformation goals without it. Most of the communications industry agrees, but when it comes to specific automation targets and priorities, it’s not always clear where the industry stands. So, we decided to ask. We conducted a series of polls on Twitter and LinkedIn, asking network decision-makers, analysts, and others who follow the industry to weigh in on CSPs’ automation progress, the barriers they face, and where they need help most. Let’s dig into the results.

Automation Priorities and Drivers

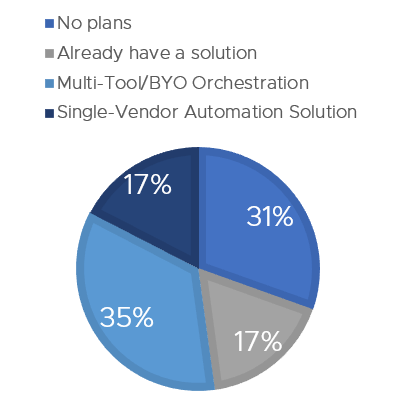

We started by asking where CSPs plan to focus their automation efforts in the coming months. We wanted to understand how they’re progressing and whether they’re using overall automation platforms or taking a piece-meal approach—either deploying different vendor automation tools or building their own.

The biggest takeaway: most operators no longer see automation as aspirational; they’re looking to automate today. Most respondents (~70%) contend that CSPs have a solution or are planning to trial or deploy one. Clearly, many CSPs are at a stage of network maturity where automation is a viable option to open up new LTE/5G service opportunities for their customers. The split among perspectives suggests, however, that many are still seeking guidance about the optimal path.

Notably, among CSPs with planned or existing solutions, roughly a third are taking a patchwork automation approach using multiple tools and vendors. The industry suggests that, while CSPs are highly motivated to automate, they’re concerned with minimizing costs and maximizing flexibility. As we will see, however, this approach can actually make it harder to achieve other important transformation goals—such as multi-cloud scalability and end-to-end network management—which only a centralized, horizontal solution can offer.

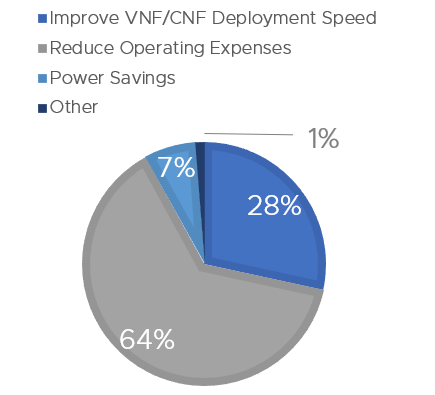

Next, we asked respondents to rank their biggest drivers for investing in automation.

These results indicate that CSPs view automation journeys as a two-step undertaking. The first priority for most is reducing operating expenses—specifically, shifting from manual operations to automated Day 0-2 lifecycle management (LCM) of network applications and services. Next, and very much contingent on minimizing manual tasks, they want to accelerate paths to revenue. By increasing VNF/CNF deployment speed, CSPs expect to more quickly create revenue-generating services.

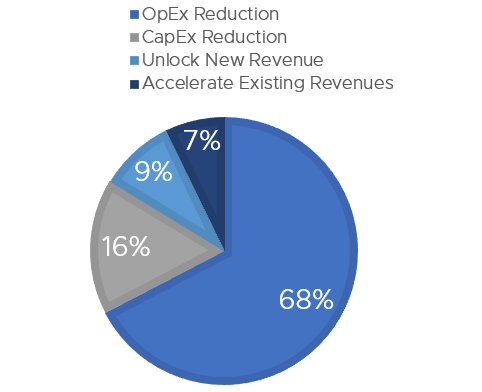

We also asked which financial factors were top of mind.

Unsurprisingly, the industry agrees that view lower OpEx is the key financial outcome from automation. Of course, the three other factors are tightly linked to the first. By focusing internally first, freeing engineers from spending all their time on manual tasks, CSPs can then empower their people to turn outward. For example, once manual tasks are automated, network operators can then focus less on executing these manual tasks and instead devote more time to creating revenue-generating network services for customers.

Automation Strategy

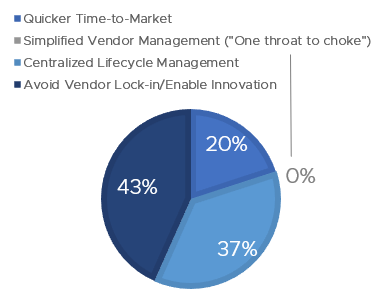

In our next polls, we wanted to understand CSP strategy for transformation initiatives. First, we asked respondents to tell us what matters most in expected automation outcomes.

Here, we see similar logic as the previous poll. CSPs are focusing both inwardly on the network—where centralized LCM is crucial to automating and consolidating operations—as well as outwardly, seeking to offer innovative, best-of-breed services to customers. However, a plurality of respondents also prioritize another important business outcome: flexibility. They feel CSPs want to automate in a way that allows them to pick and choose the ideal NFs and vendors to suit their service-creation goals.

One lesson that we believe more CSPs will appreciate as they go: it’s actually easier to choose VNFs/CNFs from different vendors, and integrate them quickly and easily into your operations, when you have a unified, overarching approach to automation rather than a patchwork of tools that all behave differently.

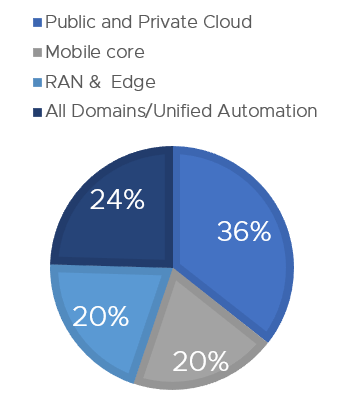

In our next poll, asking where CSPs plan to start automating, we were intrigued to find a near-even split among domains, as well as a heavy emphasis on unifying operations.

The first takeaway is that the industry recognizes a need for centralized management that cuts across domains and clouds. This matches our experience, where customers tell us that quickly growing networks bring rapidly-increasing complexity. For engineers on the front lines, it can feel nearly impossible to manage the scores of operational tasks across all the various domains and clouds.

The big lesson for CSPs is to ensure that, no matter where they start, they have a strategy for managing everything—RAN/Edge and Core, on-prem and public cloud operations—with a single pane of glass. It’s only with a centralized platform that they’ll be able to easily view, manage, and manipulate operations as their network evolves.

Next, we asked respondents about automation toolsets.

CSPs are heavily emphasizing CI/CD toolchains to support the new software requirements of virtualized/containerized NFs. At the same time, they still need workflow-based NFV automation for existing 4G/LTE environments. The risk is that, with a need to simplify both, it would be all too easy to end up with a sprawling collection of disparate tools—not ideal if the goal is to make operations simpler.

Automation Barriers

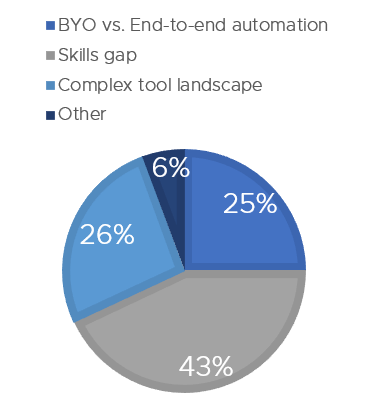

Finally, we wanted to learn more about the barriers to automation and digital transformation goals.

The high response around skills gaps reveals one of the biggest macro challenges we see CSPs face when trying to automate. How do you acquire the engineering skills and general market knowledge to both procure the right automation solution, and then implement and manage it effectively? Whether CSPs develop their own solution or look to acquire one externally, expert guidance is clearly needed.

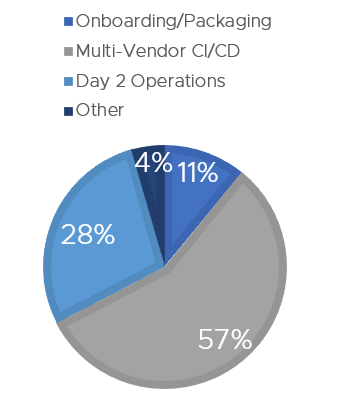

Finally, we asked about the operational issues concerning CSPs most.

Most of the industry feels confident in CSP’s ability to onboard. However, respondents see effective operation of an automated multi-vendor environment—especially as they continue to add new VNFs/CNFs, services, and vendors—as a significant ongoing challenge.

Accelerate Your Automation Journey

Overall, this polling reveals much to be encouraged by. Most of the industry not only recognizes the role of automation in business transformation, they believe CSPs are ready to start implementing it. Indeed, the biggest outstanding questions are tactical: What’s the fastest, simplest way to start automating? How can you simplify operations without locking yourself into one network vendor’s portfolio? And how can you best answer these questions when CNF/VNF orchestration skills remain so hard to find?

As leading CSPs worldwide have discovered, VMware Telco Cloud Automation offers an excellent answer to these concerns. It abstracts away the complexity of diverse vendors and clouds, and enables consistent multi-cloud orchestration of network functions, services, and slices across all domains. It automates Day 0-2 LCM for VNFs/CNFs, and accelerates time-to-market for new revenue-generating services. At the same time, it preserves the flexibility to onboard NFs from multiple vendors, while using the same consistent operations.

This combination of capabilities stands in stark contrast to other automation approaches—especially those using multi-tool/BYO solutions, which can add as much new complexity as they automate away. And there’s more to come. VMware Telco Cloud Automation’s upcoming Workflow Hub, for example, will allow CSPs to assemble end-to-end DevOps automation workflows that cover everything from infrastructure setup to application deployment, testing, and LCM. It will serve as a unified pipeline for workflow creation and ongoing integration of diverse internal and external tools. Telco Cloud Automation is also backed by VMware professional services and support to help you quickly implement and continually benefit from automation as your business evolves. Want to learn more about how VMware is helping CSPs overcome their biggest operational challenges and digitally transform their businesses? Visit telecom.vmware.com.

Discover more from VMware Telco Cloud Blog

Subscribe to get the latest posts sent to your email.