by: VMware IT M&A and Services Sr. Director Romy Kaura

In our fast-paced business landscape, the aggressive interest rate hikes by the Federal government, market volatility, and the need for strategic pivoting increase enterprise divestment opportunities. As CEOs reassess their portfolios, it is crucial to identify and divest assets that no longer align with our long-term vision. Divestitures not only unlock hidden shareholder value but also generate cash to fuel growth and innovation.

As organizations seek to adopt asset-light business models, divestiture execution in a timely and cost-effective manner has become more critical. By shedding noncore assets, companies can unlock hidden value and redirect resources toward strategic initiatives. This involves transferring people and capabilities such as processes and technology to the buyer. However, executing a divestiture is often more challenging than acquiring a business. Various types of buyers, such as corporate/strategic buyers and private equity firms, have distinct goals and requirements.

Planning from both the buyer and the seller is crucial to a successful divestiture. Needs like back-office systems and other corporate infrastructure support from the seller, level of knowledge and experience relevant to run the acquired business, TSA (transition service agreement) terms and timing considerations, and financial resources vary for different buyers. Also, decisions from one area can have a huge impact on other areas if interdependencies are not understood and addressed effectively. For instance, a decision to move in-scope employees to buyer sites would have a significant impact on employee productivity and business continuity if the network and system dependencies between the seller company assets (data centers, branch offices, cloud, systems) and buyer sites and systems are not clearly defined and addressed prior to any employee move.

To manage scenarios like these, the VMware M&A team developed a divestiture execution mind map to articulate the end-to-end IT M&A interactions with cross-functional teams, highlight interdependencies between distinct functions, and effectively cover potential IT entanglements, size, and scope of the deal. See Figure 1.

Whether a company is planning a spin-off or carve-out, or is selling the entire business, analyzing the impact on foundational pillars like customers, partners, colleagues, and product offerings is essential. This analysis should begin at the pre-separation strategy and planning stage, and it requires the same strategic focus that goes into preparing the spin-off or carve-out financials.

Pillars of divestiture execution

1. For “in-scope” customers and partners, the challenge of complex tech portfolios that encompass both homegrown business units and acquired entities is disentangling front-end and back-end systems, shared infrastructure, and complex solution sets. Companies often enter multiyear customer contracts comprising complex solution sets. These solution sets are built on technology stacks or platforms that have layers upon layers of underlying commercial agreements (licensing, royalty, revenue sharing) with other third-party collaborators and vendors. These agreements are typically shared across multiple products and services that further complicate the process. This becomes especially challenging for the seller when a customer does not consent to assign the rights and obligations to a new buyer at deal close and instead expects the seller to continue to fulfill the contract through expiration.

It is crucial to identify and understand commercial contracts, data sharing and privacy requirements, shared business processes, ongoing product support, and customer-related obligations. Maintaining business continuity and ensuring positive customer and partner experiences are paramount during a divestiture. See Figure 2.

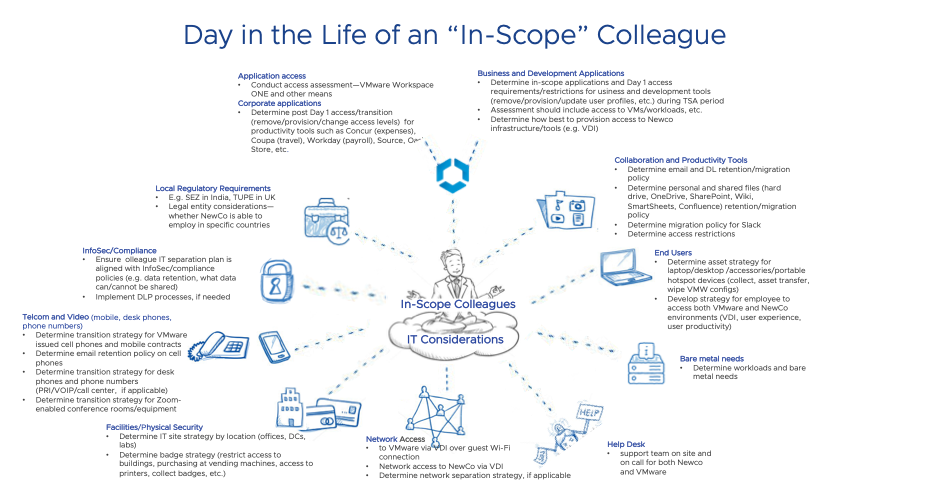

2. For “in-scope” colleagues, crucial considerations include retaining key talent and ensuring positive colleague experience during divestment. Colleagues involved in divestiture must balance their regular responsibilities while handling divestiture-related tasks. Understanding their needs starting from Day 1 through the transition service agreement period is essential. This includes providing access to corporate and engineering systems, managing workloads and facilities, addressing collaboration and productivity requirements, facilitating data sharing and migration, and ensuring helpdesk support. By prioritizing the well-being and engagement of colleagues, divestitures can proceed smoothly. See Figure 3.

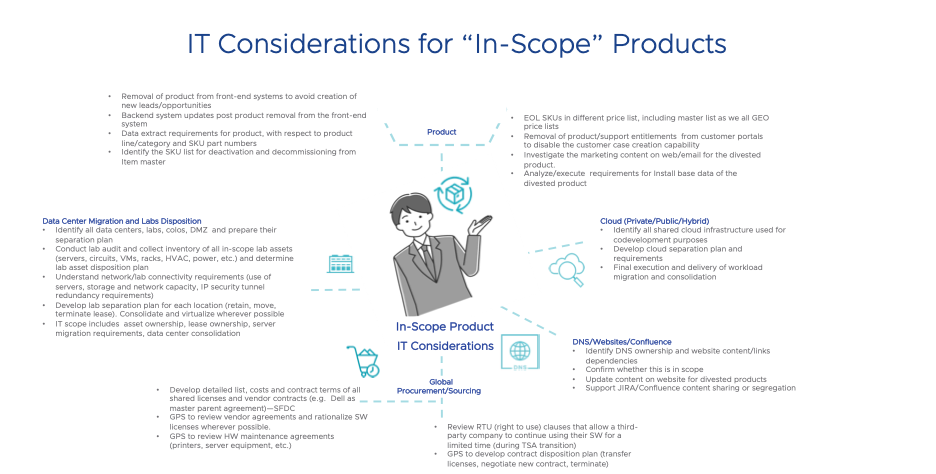

3. For “in-scope” products, technology solutions are often a mix of various products and services comprising an intricate web of in-house and licensed IP assets (source code, patents, IP contributions, copyrights) spread across legal entities, business units, and regions. While the primary in-scope product is usually clear, its auxiliary revenue, costs, assets, legal entity structure, affiliated people, processes, systems, and contracts can be clouded by financial and operational entanglements that make separations complex. Tech products frequently rely on multiple IP assets that are shared across several products, resulting in complex many-to-many interdependencies. Thoroughly reviewing these entanglements and assessing their impact is critical for ensuring a seamless divestiture process. See Figure 4.

Divestiture can be a technology enabler

Drawing on the VMware M&A team’s experience, it is evident that a framework alone is insufficient. Divestiture execution is a multifaceted process that requires careful planning, meticulous attention to detail, and leveraging technology as a powerful enabler. The true secret lies in employing proven and robust technologies that can adapt to any scenario. Solutions like VMware Workspace ONE®, VMware Horizon® desktop virtualization, and VMware Multi-Cloud play instrumental roles in execution.

By understanding the pillars of divestiture execution and embracing technology-driven approaches, companies are empowered to navigate the complexities, maximize value, and ensure a successful divestiture execution.

Divestiture execution is only unique to each company. That’s why we encourage you to contact your account team to schedule a briefing with us. No sales pitch, no marketing. Just straightforward peer conversations revolving around your company’s unique requirements.

VMware on VMware blogs are written by IT subject matter experts sharing stories about our digital transformation using VMware products and services in a global production environment. To learn more about how VMware IT uses VMware products and technology to solve critical challenges, visit our microsite, read our blogs and IT Performance Annual Report, and follow us on SoundCloud, Twitter and YouTube. All VMware trademarks and registered marks (including logos and icons) referenced in the document remain the property of VMware.